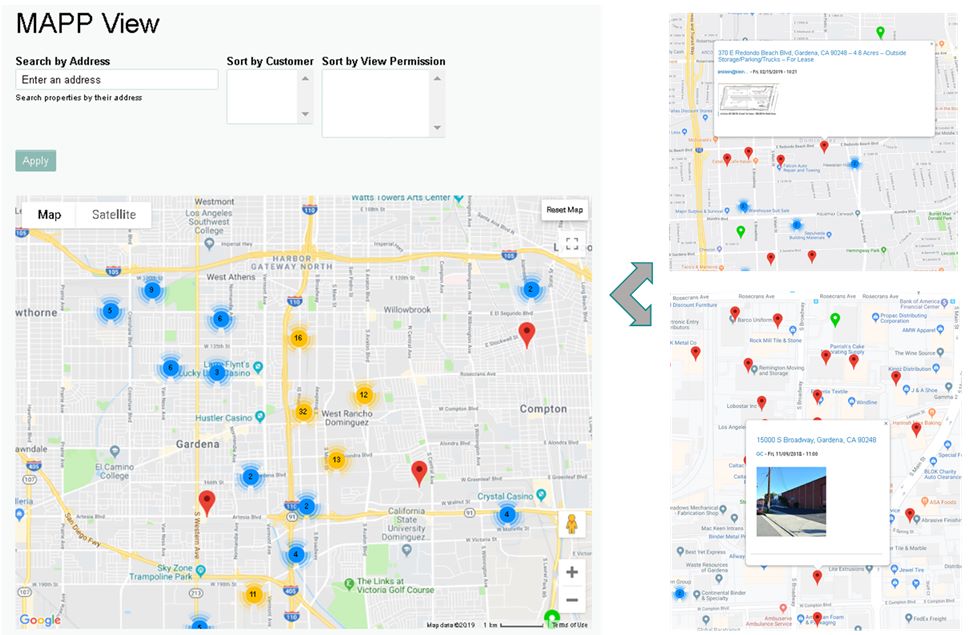

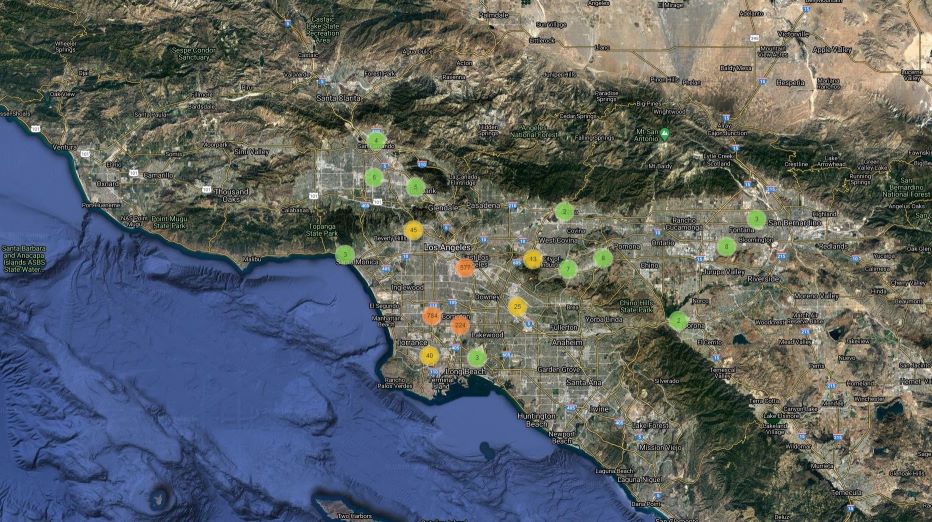

MappSnap.com is a analytics tool based on location data. We combine parcel, tenant, image, video and point data to create geographic intelligence. Proximity marketing, archiving, and searching are a few examples of MappSnap uses.

All processes and algorithms are our own custom design directed specifically to industrial building brokerage and acquisition. The underlying GIS programming has been developed over many years with programmers around the world. Using geo-data to create industrial deals is our competitive advantage.

Please feel free to contact us in order to help you with industrial property.

(Please review our Privacy Policy for information on how we may utilize your data)